Individual Nol Carryback 2025 Tax Year

Individual Nol Carryback 2025 Tax Year. For tax year 1, business a has $100,000 of gross income and $125,000 of tax deductions. The cares act temporarily allowed taxpayers to carry back 100% of nols arising in tax years beginning after 2017 and before 2025 to the prior five tax years, effectively.

The requirement that excess business losses be carried forward as part of an nol forces taxpayers who have losses in excess of the thresholds (discussed below) to wait at least one year to get a tax refund in connection with those. A taxpayer generally must file an election to waive an nol carryback period by the due date, including extensions, of the income tax return for the year in which the nol arose (code sec.

Individual Alternative Minimum Tax Planning and Strategies ppt download, Businesses thus are taxed on average profitability, making the tax code more neutral.

Nol Carryover Explanation Example, Taxable income is computed for purposes of § 170(b)(2) without regard to the charitable contribution deduction or any nol carryback to the taxable year.

Net Operating Loss NOL Carryover Deduction San Jose CPA, Therefore, depending on the circumstances, the taxpayer may wish to instead carry back the.

Tax Loss Carryforward NOL How to Report NOL Carryforward? YouTube, The requirement that excess business losses be carried forward as part of an nol forces taxpayers who have losses in excess of the thresholds (discussed below) to wait at least one year to get a tax refund in connection with those.

Nol Carryover For Individuals, A net operating loss (nol) carryback allows businesses suffering losses in one year to deduct them from previous years’ profits.

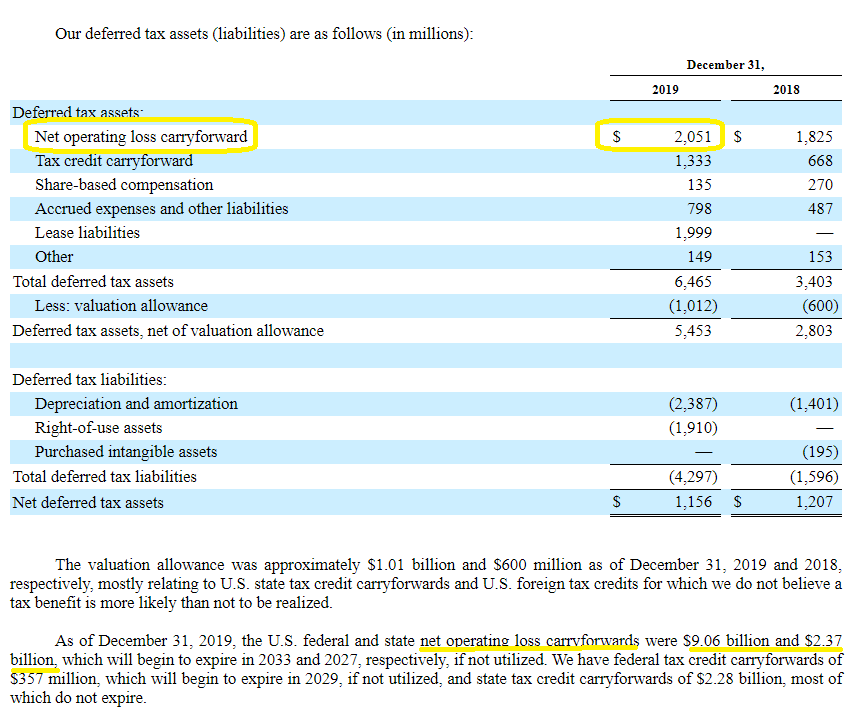

(NOL) Net Operating Loss Carryforward Explained Losses Assets, For tax year 1, business a has $100,000 of gross income and $125,000 of tax deductions.

Accounting for Tax, Taxable income is computed for purposes of § 170(b)(2) without regard to the charitable contribution deduction or any nol carryback to the taxable year.

Federal Nol Carryover Rules, A net operating loss (nol) carryforward allows businesses suffering losses in one year to deduct them from future years’ profits.

Loss Carryback AwesomeFinTech Blog, Taxable income is computed for purposes of § 170(b)(2) without regard to the charitable contribution deduction or any nol carryback to the taxable year.